Insurance for your storage unit is a dedicated policy that protects your belongings from things like fire, theft, and water damage while they’re stored away from home. Your standard home insurance might offer some cover, but it's often not enough, leaving your items underinsured when you need protection the most.

Why Your Stored Items Need Specialised Insurance

Think of your Orange Box Self Storage unit as your personal vault. We’ve got the physical security covered with 24/7 CCTV and secure access, but that doesn’t act as a financial safety net if the unexpected happens. That’s where insurance for contents in a storage unit comes into play.

It's a common mistake to assume your home insurance automatically extends to cover everything you put in storage. Unfortunately, this assumption can lead to a costly and dangerous gap in your cover. A standard policy might provide a bit of "off-premises" protection, but it usually comes with some serious limitations.

The Limits of Standard Home Insurance

Home insurance policies are built for items kept inside your house. The moment you move things to an external location like a storage unit, the risks change, and so does the level of cover. Here’s what you’ll likely run into:

- Lower Coverage Limits: The amount of cover for items stored off-site is often capped at a small fraction of your total personal property limit—think around 10%. So, if you have £30,000 of contents cover for your home, you might only have a mere £3,000 for everything in your storage unit.

- Excluded Perils: Some home policies won't cover risks specific to storage environments. This could include damage from certain types of water leaks that are more common in storage facilities than in a typical home.

- Higher Excess: If you do need to make a claim for items in storage, you might find yourself paying a higher excess than you would for a claim on items damaged at home.

A dedicated storage unit policy is built from the ground up to handle the unique risks of storing goods off-site. It provides tailored protection where a general home policy simply can't keep up.

The Value of Purpose-Built Cover

Choosing a specialised insurance policy means your possessions are protected based on their actual value and the real-world environment they're in. It takes the guesswork out of the equation and protects you from the financial sting of relying on inadequate home cover.

Getting the right insurance is just as vital as packing your items correctly; both are crucial for avoiding the common storage unit mistakes that people often make. To get a better handle on the basics, it helps to delve deeper into personal property coverage as a whole. This guide will walk you through everything you need to know.

Decoding Your Storage Insurance Policy

Let's be honest, trying to make sense of an insurance policy can feel like you're reading a foreign language. It’s packed with terms you’d never use in a normal conversation, and when it comes to insurance for contents in a storage unit, the small print really does matter. So, let’s cut through the jargon and break it all down into simple, practical terms so you know exactly what you're signing up for.

Most policies are built around one of two core ideas. A good way to think about it is like ordering food at a restaurant.

- Named Perils: This is your à la carte menu. The policy gives you a specific list of events, or "perils," that you're covered for – think fire, lightning strikes, or vandalism. If something happens that isn't on that list, you're out of luck.

- All-Risk (or Open Perils): This is more like the set menu. It covers pretty much everything unless an event is specifically named as an exclusion. This usually offers wider protection, but you’ll want to pay very close attention to that list of exclusions.

What Your Policy Typically Covers

A good insurance policy for your stored belongings should act as a safety net against the most common disasters. While the specifics can vary from one provider to another, most standard plans are there to protect your things from sudden and accidental damage.

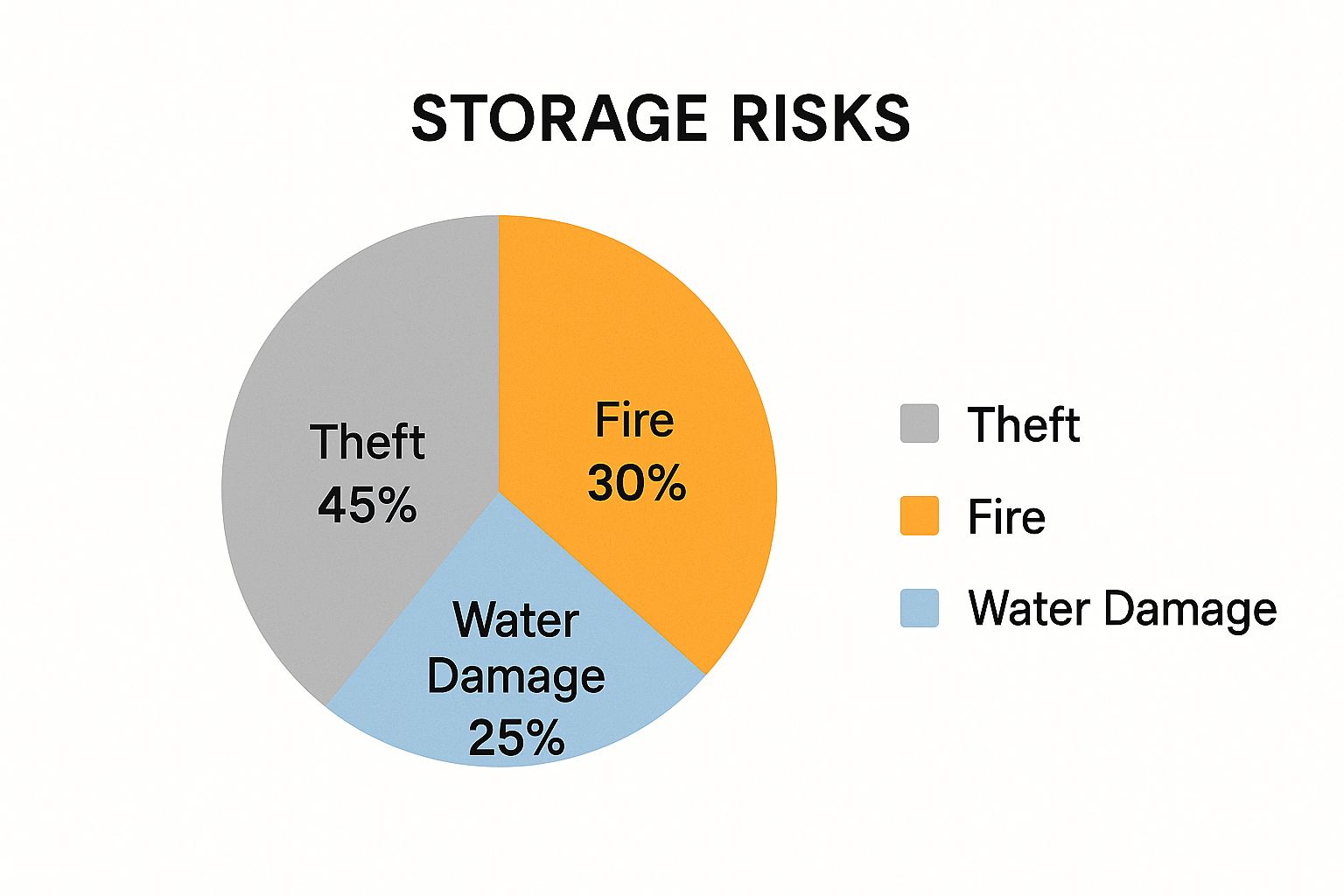

The chart below shows the most common reasons people make insurance claims for items in storage.

As you can see, theft is by far the biggest threat, followed by fire and water damage. This makes it absolutely essential to have cover for these three events.

Understanding Common Exclusions

Knowing what isn’t covered is just as important as knowing what is. Insurance is designed to cover unexpected accidents, not problems that crop up because of neglect or things that happen naturally over time.

It’s a crucial distinction: insurance covers a pipe bursting and flooding your unit, but it likely won't cover mould that grows over several months due to damp conditions and improper packing. One is an accident; the other is a preventable issue.

To make things clearer, let's look at what's usually included in a standard storage insurance policy versus what's often left out.

Storage Insurance Coverage At-a-Glance

This table gives you a quick overview of what to expect from a typical policy. It helps to see what’s usually covered straight out of the box and what might need a special add-on or a different type of policy altogether.

| Event | Typically Covered | Typically Excluded (or requires special cover) |

|---|---|---|

| Theft | Covered when there are clear signs of forced entry (e.g., a broken lock or damaged door). | "Mysterious disappearance" where there is no evidence of a break-in. |

| Fire & Smoke | Damage caused by fire originating inside or outside the facility. | Arson committed by the policyholder. |

| Water Damage | Damage from sudden events like a burst pipe or a leaking roof. | Gradual damage from mould, mildew, or rot. Flood damage often requires separate cover. |

| Pest Damage | Not usually covered, as facilities have pest control measures. Damage is often seen as preventable. | Damage from rodents, insects, or other vermin. |

| High-Value Items | Basic cover for standard household goods and furniture. | Jewellery, cash, fine art, or collectibles often have low limits or are excluded entirely. |

Taking the time to read through these details is the single best way to avoid any nasty surprises if you ever need to make a claim. It puts you in control, allowing you to pick a policy that genuinely matches the real-world risks your belongings might face.

Will Your Home Insurance Cover Your Storage Unit?

Relying on your home insurance to protect your belongings in storage is one of the most common—and potentially costly—assumptions people make. While many policies have a feature called ‘goods away from home’ cover, it’s rarely a good substitute for proper insurance for contents in a storage unit.

Think of this cover as a travel-sized version of your main policy. It’s really designed for short-term situations, like protecting your laptop on holiday, not for safeguarding a whole unit of furniture and personal treasures over several months or even years.

That distinction is critical, mainly because of the significant limitations that usually apply once your items leave your property.

Uncovering The Limits In Your Policy

The biggest catch with relying on home insurance is the dramatically reduced cover for anything not under your own roof. The protection you get is often just a small fraction of your total personal property coverage.

For example, your policy might only cover off-premises goods up to 10% of your total contents limit. So, if you have £40,000 of cover at home, that leaves a mere £4,000 for everything in your storage unit—which might be far less than what it's all actually worth.

Here’s what to look for when you pull out your policy documents:

- Off-Premise Storage Clause: Hunt for specific wording like "off-site storage" or "property away from the home." This is where you'll find the exact percentage or monetary limit.

- Peril Exclusions: Check if the policy excludes certain risks that are more common in storage environments, like specific types of water damage or mildew.

- Higher Excess: You might find that making a claim on stored items comes with a higher excess payment than a claim for items damaged at home.

It's always a good idea to check what you already have before buying something new. For example, a detailed guide can explain whether your renters insurance covers storage units, which could offer some level of protection.

Digging into these details often makes it clear why a dedicated storage policy is the smarter move. It's specifically built for the unique environment of our secure self storage options in Nottingham, making sure you have the right protection when you need it most.

How to Accurately Value Your Stored Belongings

Choosing the right amount of cover is a massive part of getting insurance for contents in a storage unit. If you aim too low, you could be left seriously out of pocket after something goes wrong. On the flip side, overestimating means you'll just be paying higher premiums for protection you don't actually need.

Getting this figure right is all about peace of mind.

This isn’t about plucking a number out of thin air. It’s about creating a clear, documented list of everything you plan to store. This inventory is your most powerful tool, both for buying the right level of insurance and for proving what you owned if you ever need to make a claim.

Replacement Value Versus Actual Cash Value

Before you start tallying everything up, you need to understand how insurers actually value your stuff. Most policies, especially the good ones for self-storage, work on a Replacement Value basis. This is great news for you.

- Replacement Value: This is what it would cost to pop down to the shops and buy a brand-new, similar item today. If your five-year-old sofa gets destroyed, this cover pays for a new, comparable one—not the £50 you might get for it on Gumtree.

- Actual Cash Value (ACV): This is the replacement cost minus depreciation. It basically reflects the "second-hand" value of your items, and the payouts are almost always lower.

Always double-check that your policy uses Replacement Value. It ensures you can actually replace what you've lost without raiding your own savings, giving you a much stronger financial safety net.

The goal is to calculate the total cost of replacing everything in your unit as if you were buying it all again today. This final figure is the amount of cover you should purchase.

Creating Your Storage Inventory

A detailed inventory is non-negotiable, but it doesn't need to be a huge headache. A simple spreadsheet or even a notebook will do the job perfectly. The secret is just to be thorough and organised from the start.

Here’s a straightforward, four-step process to value your belongings accurately:

- List Everything: Go through your items box by box, listing each significant item. For smaller things like kitchenware or books, you can group them and estimate a total (e.g., "Kitchen contents – £400").

- Take Photographs: Use your phone to take clear pictures of your items, especially anything high-value. A quick snap of your TV's serial number or the brand name on an appliance can be priceless evidence later on.

- Find Receipts: For recent purchases or expensive items like electronics and furniture, try to dig out any receipts or credit card statements. This is concrete proof of value that insurers love.

- Research Current Prices: For older items without receipts, a quick online search will tell you what it would cost to buy a similar new product today. This is how you nail down the correct replacement value.

Once your list is complete, just add up the replacement values for everything. That final number is the amount of insurance cover you need, giving you the confidence that your belongings are properly protected.

Comparing In-house and Standalone Insurance Costs

When you’re at the counter renting a storage unit, you’ll almost certainly be offered insurance. It’s convenient, quick, and seems like the path of least resistance. But that convenience often comes with a surprisingly high price tag—a classic example of the 'convenience trap'.

While in-house policies are straightforward, they can carry seriously inflated premiums. You’re paying for the ease of a one-stop shop, but the lack of direct competition right there at the point of sale means prices can be much higher than what a quick online search would turn up. For many customers, this hidden cost goes completely unnoticed.

The True Cost of Convenience

Shopping around for insurance for contents in a storage unit is one of the smartest financial moves you can make. The price difference between a policy bought from the facility and one from a specialised third-party provider can be huge.

Recent research highlights just how significant this gap is. One study found that UK customers buying insurance directly from their storage provider often overpay by an average of three times, with some premiums being up to nine times higher than online alternatives. The same investigation discovered that in 90% of cases, it was cheaper to purchase storage insurance online rather than through the facility itself. You can read the full research about these insurance findings to get a better sense of the market.

Why Are Standalone Policies Often Cheaper?

Third-party insurance providers operate in a competitive online marketplace, which naturally drives prices down as they compete for your business. They specialise in insurance and nothing else, allowing them to fine-tune their pricing and offer more comprehensive cover for less.

Think of it like buying snacks at the cinema. You can grab a chocolate bar there for a premium price because it's right in front of you. Or, you could pop into a supermarket beforehand and buy the exact same bar for a fraction of the cost. The product is identical; the price is all about the convenience of the location.

By taking just a few minutes to compare quotes online, you put yourself in the driver's seat, making a decision based on value, not just convenience. It’s a simple step that ensures your belongings are protected without you having to overpay, freeing up money that could be better spent elsewhere.

Choosing the Best Policy for Your Storage Unit

Putting everything together, picking the right insurance for contents in a storage unit is pretty straightforward once you know what you’re looking for. With a clear checklist, you can confidently find a policy that protects your belongings without breaking the bank, giving you total peace of mind for your Orange Box Self Storage unit.

Your first step is to confirm that insurance is actually necessary—which, let’s be honest, it almost always is. From there, it's about understanding exactly what your chosen policy covers. Pay close attention to the difference between 'named perils' and 'all-risk' cover, and always, always read the exclusions list. This simple check ensures there are no nasty surprises if you ever need to make a claim.

A Final Checklist for Success

Next up, you’ll want to accurately value your belongings using the 'replacement value' method we talked about earlier. It's a simple but crucial step that prevents you from being under-insured and facing a financial headache down the line. With your valuation sorted, you can start comparing quotes.

Here's a quick rundown to keep you on track:

- Confirm Your Needs: Take a moment to re-evaluate why you need cover and what specific items you're protecting. This helps you dodge paying for extras you don't actually need.

- Compare Providers: Don't just settle for the convenient in-house option. It's always worth getting quotes from at least two standalone insurance providers to see how much you could save.

- Read the Small Print: Double-check the excess amount and any specific conditions related to your storage unit type. Our guide on indoor vs container storage can help clear up which type is best for your situation.

- Secure and Document: Once you've chosen a policy, keep a digital copy of your documents safely stored alongside your inventory list.

The UK self-storage market is booming, with 2,900 facilities now operating across the country. While security measures like CCTV are pretty standard these days, they're no substitute for proper insurance against things like theft or damage. Following these steps empowers you to make a smart, informed decision, leaving your valuables safe and your wallet happy.

Still Have Questions? Let's Clear Things Up

When it comes to insurance for your storage unit contents, a few questions always pop up. It's completely normal to want to get the details right. Let's walk through some of the most common queries to make sure you've got all the answers you need to finalise your protection plan.

Do I Actually Need Insurance For My Storage Unit In The UK?

While the government doesn't have a specific law forcing you to insure goods in storage, you'll find that almost every self-storage facility in the UK—including Orange Box Self Storage—will ask for proof of insurance. It's a standard part of the rental agreement.

Think of it as a safety net for everyone involved. It protects you from loss, and it protects the facility too. You're always free to find cover from your own provider or go with the in-house option, but having an active policy is a must before you can start moving your things in.

What Happens If I Under-Insure My Belongings?

This is a really important one. Under-insuring your items can lead to some serious financial disappointment if you ever need to make a claim. Most policies have something called an 'average clause' to deal with this exact scenario.

Here’s a simple breakdown: if you insure your belongings for only 50% of what they’d actually cost to replace, your insurer might only pay out 50% of your claim, regardless of the total loss. This is precisely why taking the time to create an accurate inventory and calculate the true replacement value is so critical for your own financial security.

The 'average clause' is there to stop someone from insuring £20,000 worth of stuff for a mere £5,000, then trying to claim the full £5,000 after a minor incident. It keeps things fair by making sure your potential payout is directly linked to how accurately you valued your goods in the first place.

Can I Insure Items In A Container Storage Unit?

Yes, absolutely. You can definitely insure items you're keeping in an outdoor container unit. Just be aware that the policy terms and the price might look a bit different from what you'd get for a standard indoor unit.

Insurers often have specific security standards for container sites to make sure everything is properly protected. These typically include things like:

- A solid perimeter fence surrounding the entire facility.

- Comprehensive CCTV cameras covering the site.

- Using a heavy-duty, high-quality padlock on your own unit.

Always be upfront with your insurance provider about the exact type of unit you’re renting. It's the only way to guarantee your policy stays valid and your items are covered properly.

How Do I Make A Claim For Damaged Or Stolen Goods?

If the worst happens and you find your items have been damaged or stolen, your first step—if a crime has been committed—is to contact the police. You'll need a crime reference number. Straight after that, let both the storage facility management and your insurance provider know what's happened.

Your insurer will then walk you through their claims process. This usually means filling out a form and providing proof of your loss. This is where your detailed inventory, photos, and any receipts you kept become invaluable. Acting fast and having clear documentation are the keys to making the whole process as smooth and successful as possible.

Ready to secure your belongings with a storage solution you can trust? At Orange Box Self Storage, we provide top-tier, secure units perfect for your needs. Find your ideal storage unit with us today!