Think of contents insurance for your storage unit as a dedicated safety net for your belongings. It’s a specialised policy designed to financially protect your stuff while it's stored away from home, because your standard home insurance often provides insufficient or even no coverage for items kept off-site. This way, you’re covered if something unexpected happens, like a fire, theft, or water damage.

What Is Storage Unit Insurance?

Imagine your storage unit as a garden shed or a garage, but located a few miles away. While your home insurance is great for what’s under your main roof, its protection rarely stretches that far. This is where contents insurance for storage units comes in. It provides a crucial financial safeguard specifically for those items you've put into storage.

This isn't just an optional extra; for most facilities, including ours at Orange Box, it's a mandatory requirement. We provide top-tier physical security—we're talking 24/7 CCTV and secure access controls—but insurance offers a different kind of protection. It’s the financial peace of mind that means you can replace your valued possessions if the worst should happen.

Why Standard Home Policies Fall Short

It’s a common—and often costly—mistake to assume your home or renter's insurance has you covered. The reality is that most standard policies have an 'off-premises' clause that severely limits coverage for anything not at your insured address.

These policies often come with catches like:

- Lower Coverage Limits: They might only cover up to 10% of your total contents value for items stored elsewhere.

- Specific Exclusions: Many policies explicitly rule out covering property held in commercial storage facilities.

- Time Constraints: Coverage might only be temporary, for instance, just for the short period while you're moving house.

This coverage gap is precisely why specialised storage insurance exists. It's built to protect everything from furniture and electronics to vital business documents against risks your primary policy won’t touch.

The need for this kind of protection has grown right alongside the self-storage industry. There are now over 2,200 facilities across the UK, and with occupancy rates pushing past 90%, having the right insurance is more critical than ever. This high demand doesn't just affect storage availability; it also reinforces the need for a dedicated policy. You can get a deeper look at these industry trends in this analysis of the UK self-storage market.

Choosing Your Insurance Provider

When it comes to insuring your items in storage, you generally have two paths to take: buy a policy directly from the storage facility or sort out cover with an independent, third-party provider. Each route has its own pros and cons, and it’s well worth taking a moment to weigh them up.

Going with the facility's own insurance is often the path of least resistance. It's a simple, one-stop solution where you get your insurance sorted at the same time as your rental agreement. Quick and easy. However, that convenience can often come at a premium.

Convenience Versus Cost

Choosing between your storage facility and an independent insurer really comes down to balancing ease against your budget. While the facility-provided plans are incredibly quick to set up, specialist independent providers can often offer more competitive prices and flexible terms because, well, this is what they do all day.

The difference in price can be pretty staggering. Research into the UK self-storage insurance market has found that customers buying directly from facilities are routinely overpaying. In fact, in 90% of cases, it’s cheaper to get a policy online from a third-party provider. Some figures even suggest facility policies can cost up to nine times more than similar cover found elsewhere. You can read the full research about storage insurance pricing to get a better sense of the potential savings.

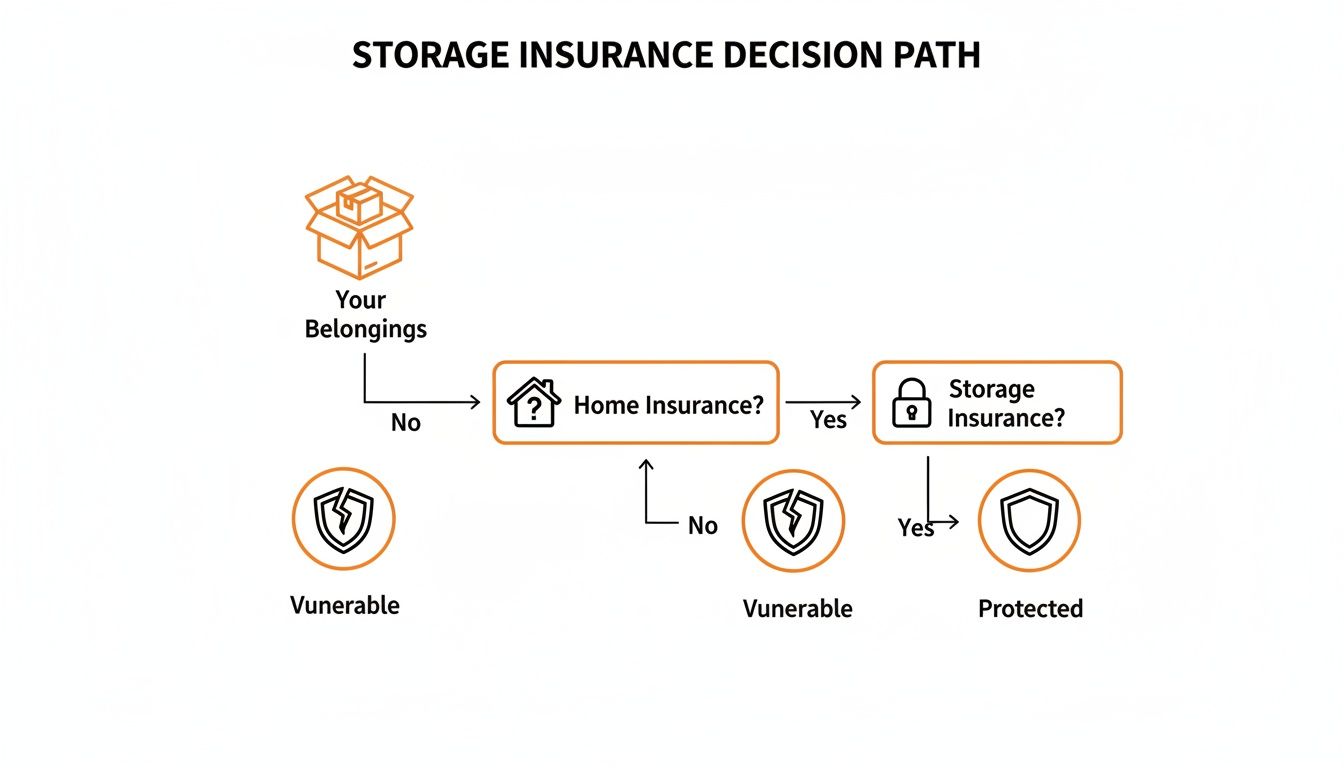

This flowchart maps out the core decision. Relying on your home insurance might seem like an easy win, but its gaps often leave your items vulnerable. Dedicated storage insurance, on the other hand, makes sure they're properly protected.

The main takeaway here is simple: while using your home insurance is tempting, its limitations make a specialised storage policy the most reliable way to get full protection.

Making an Informed Decision

Seeing a direct comparison always helps make the best choice. Think about what matters most to you—the total value of your belongings, how long you'll be storing them, and of course, your budget. A good provider will give you the right level of cover without any unnecessary expense.

Here’s a quick look at how the two options stack up:

Storage Insurance Provider Comparison

| Feature | Facility-Provided Insurance | Third-Party Insurance |

|---|---|---|

| Convenience | Excellent. Set up in minutes alongside your rental agreement. | Good. Requires a separate online application, but is still very quick. |

| Cost | Often significantly higher, sometimes by a large margin. | Typically much cheaper, offering substantial savings. |

| Coverage Flexibility | Can be rigid, with fixed coverage tiers. | More flexible, often allowing you to tailor cover to your needs. |

| Expertise | Staff are storage experts, not necessarily insurance specialists. | Provided by insurance specialists who understand the nuances of storage cover. |

| Claim Process | Varies by facility; may involve multiple parties. | Direct and streamlined process with the insurance provider. |

Ultimately, choosing the right insurance boils down to what you value more: the all-in-one setup from your storage facility or the big savings you can get from an independent insurer.

Before you commit to anything, always get a quick quote from at least one independent provider. It only takes a few minutes and gives you a clear benchmark for what you should be paying for contents insurance for storage units.

Taking a moment to compare your options ensures your belongings are not just secure, but also insured in the most cost-effective way possible.

Understanding What Your Policy Actually Covers

Knowing you have insurance for your storage unit is a good start, but the real peace of mind comes from understanding the fine print. Think of your policy like a protective bubble around your belongings—it’s strong, but you need to know what can poke through. It’s crucial to get clear on exactly what is and isn't shielded from day one.

Most policies are built to protect you from sudden, unexpected events, often called "perils" in the insurance world. These are the out-of-the-blue disasters that can cause real damage.

What Is Typically Covered

Your insurance is there to step in when something goes wrong unexpectedly. While the details can vary from one provider to another, most standard storage insurance plans will cover your financial losses from things like:

- Fire: Damage caused by a fire breaking out within the facility.

- Theft from Forced Entry: This is a key detail. There must be obvious evidence of a break-in, like a busted lock or a pried-open door.

- Flooding and Water Damage: This generally covers incidents like a burst pipe inside the building or water getting in from a severe storm.

- Vandalism: Malicious damage done to your unit or the items inside.

These core protections are the foundation of most policies, making sure you’re covered for the most common and significant risks that come with storing your belongings.

Common Exclusions to Be Aware Of

Just as important as knowing what’s covered is understanding what isn’t. Insurance providers have to draw a line somewhere, and that means certain types of damage and specific categories of items are usually excluded.

A policy's value isn't just in what it covers, but also in the clarity of its exclusions. Knowing these limits beforehand prevents major headaches if you ever need to make a claim.

Typical things your policy won't cover often include:

- High-Value Items: Things like cash, securities, jewellery, and fine art are almost always on the exclusion list. Their value is just too high and difficult to prove, so they fall outside standard cover.

- Gradual Damage: This is a big one. Problems that develop slowly over time—think mould, mildew, rust, or a pest infestation—are not usually covered. This is precisely why proper packing and considering your storage environment is so important. You can learn more about how specialised units help reduce these risks in our guide to climate-controlled storage units.

- Vehicles: Cars, motorbikes, and other motorised vehicles need their own specific insurance policies. They are never covered by a standard contents insurance plan for a storage unit.

To really get to grips with your specific policy, it’s worth learning how to read an insurance policy effectively. Taking a bit of time to understand the documents means no nasty surprises down the road, giving you complete confidence that your stuff is properly protected.

How to Calculate Your Insurance Costs

Figuring out what your insurance will cost isn't as tricky as you might think. It all boils down to one key thing: the total replacement value of everything you’re putting into storage. Nailing this figure is the secret to getting the right cover without overpaying.

Think of it like this: you need to work out what it would cost to walk into a shop today and buy every single one of your items again, brand new. This is what insurers call the "new-for-old" replacement value. It’s not about what you could sell them for, or their sentimental worth.

Get this number too low, and you risk being underinsured, which could leave you seriously out of pocket if you need to make a claim. On the flip side, overinsuring just means you're paying a higher premium for cover you don't actually need. Getting it right ensures you're perfectly protected without wasting a penny. It’s also a crucial first step in budgeting for your total storage costs, and we have a helpful guide if you want to learn more about how much self-storage costs in the UK.

Create Your Storage Inventory

The most reliable way to get an accurate valuation is to create a detailed inventory. The best approach is to go through your belongings room by room or category by category.

- List Major Items: For furniture, electronics, and appliances, jot down the brand and model. A quick online search will tell you their current retail price.

- Group Smaller Items: For things like books, kitchenware, or clothes, it’s perfectly fine to estimate their value as a group. For instance, a box of 50 books might cost £500 to replace new.

- Don't Forget Photos: Take pictures or even a quick video of everything before it goes into the unit. This is invaluable proof of what you owned and its condition if you ever need to file a claim.

Getting an accurate valuation is essential. A precise inventory not only determines your premium but also speeds up any future claims process, making it a vital step you shouldn't skip.

Understanding Your Premium and Excess

Your final insurance cost will also be shaped by the policy's excess. This is the fixed amount you agree to pay towards a claim before the insurer covers the rest. It’s a bit of a trade-off.

Choosing a higher excess will usually bring down your monthly or annual premium, but it means you'll have to pay more yourself if something goes wrong.

It's also worth remembering that insurance is just one part of your overall storage expense. According to the Self Storage Association UK's 2023 Report, the average annual storage rate is £29.13 per square foot. When you consider that some independent insurance providers offer policies from as little as £14.90 per year, it’s a minimal extra cost for some serious peace of mind.

Your Step-by-Step Guide to Getting Insured

Getting the right insurance for your storage unit sorted might sound like a chore, but it’s actually a pretty straightforward process when you know the steps. Think of it as a simple checklist to protect your belongings and give yourself some well-deserved peace of mind.

Breaking it down into five simple stages takes the guesswork out of it. Follow this roadmap, and you’ll go from figuring out what you’ve got to handing over your proof of insurance without any last-minute panic.

Step 1: Create a Detailed Inventory

First things first: you can’t insure your stuff if you don’t know what you’re storing. The most important place to start is with a detailed inventory list. This doesn't need to be fancy—a simple spreadsheet or even a dedicated notebook will do the trick just fine.

Work your way through everything you plan to store, making a note of each valuable item. For big-ticket things like furniture or electronics, jot down the brand and model. For smaller bits and bobs like books, clothes, or kitchenware, you can group them into categories and put down a rough estimate of how many you have. This list is the foundation for everything else.

Step 2: Calculate the Replacement Value

Once your inventory is ready, it’s time to work out the total replacement value. This is the one number your insurer absolutely needs to know. It’s not what your things are worth if you sold them tomorrow; it’s what it would cost to walk into a shop and buy everything again, brand new, today.

Use your inventory to look up current prices online for your main items. For the smaller, grouped stuff, make a sensible estimate of their new-for-old value. Add it all up, and that’s your final figure. This number is what determines how much cover you need and, in turn, how much your premium will be.

Getting this valuation right is vital. Underinsuring means you could face a serious financial hit if you need to make a claim, but overinsuring is just paying for protection you don’t actually need.

Step 3: Compare Your Insurance Options

Now that you have your key figure, it’s time to do a bit of shopping around. As we’ve covered, you can get insurance directly from your storage provider or find a policy from a specialist third-party insurer. It’s always a good idea to get quotes from both to see how they stack up on cost and coverage.

Make sure you’re looking for policies that specifically mention contents insurance for storage units. Don't forget to check the excess amount and have a quick read of the main exclusions to make sure the policy is a good match for what you’re storing.

Step 4: Purchase the Policy

Found a policy that strikes the right balance between comprehensive cover and a good price? Great, it’s time to buy it. This part is usually very quick and can often be done online in a matter of minutes. You’ll just need your personal details, the address of the storage facility, and the total replacement value you worked out earlier.

Step 5: Provide Proof of Insurance

The final step is to give a copy of your insurance certificate to the storage facility. Most insurers will email you the documents as soon as you’ve paid. All you need to do is forward that email to the facility manager or upload the document to their online portal. This confirms you’ve met their insurance rules, and you’re all set to move in, knowing your belongings are fully protected.

Making a Claim and Protecting Your Belongings

While having the right contents insurance gives you a vital financial safety net, knowing what to do if the worst happens is just as crucial. Should you ever need to make a claim, a calm, methodical approach will make the entire process run much more smoothly.

The first few moments after discovering a problem like theft or damage are critical. Before you touch a thing, document everything. Get your phone out and take clear photos and videos from multiple angles. Make sure you capture any signs of forced entry, water damage, or vandalism in detail.

Once you’ve got your evidence, your next step is to notify the facility management immediately. After that, get in touch with your insurance provider to formally kick off the claims process.

Proactive Ways to Protect Your Stored Items

An insurance policy is there for when things go wrong, but a bit of proactive protection can stop them from going wrong in the first place. Taking a few preventative steps can massively reduce the risk of ever needing to make that call. Your goal is simple: create a secure, stable environment inside your unit.

Prevention is always better than a claim. Simple packing and storage strategies can protect your belongings from the most common risks, such as moisture and theft, ensuring they remain in the same condition you left them.

Give these practical tips a try to properly safeguard your goods:

- Elevate Everything: Don't let your stuff sit directly on the concrete. Use wooden pallets or simple shelving to keep all your boxes and furniture off the floor. This tiny step provides crucial protection against ground-level moisture or minor flooding.

- Choose Plastic Over Cardboard: It’s worth investing in sturdy, airtight plastic containers. Unlike cardboard boxes, they won’t absorb dampness, get crushed over time, or become a magnet for pests. They just offer far better long-term protection.

- Invest in a High-Quality Lock: Your lock is your first and most important line of defence. Go for a heavy-duty disc or cylinder lock, which are much tougher to cut or pick than a standard padlock.

Beyond what’s in your policy, simple strategies to prevent vandalism can also cut down your risk. For a deeper dive into best practices, have a look at our guide on avoiding common storage unit mistakes.

By combining a solid insurance plan with smart storage habits, you give your belongings the best possible protection.

Frequently Asked Questions About Storage Insurance

Let’s be honest, insurance can feel like a bit of a minefield. To make sure you feel completely comfortable and know exactly what you’re signing up for, we’ve put together answers to the most common questions we hear about insuring your items in storage.

Do I Really Have to Get Insurance for My Storage Unit?

Yes, you do. Pretty much every self-storage facility in the UK, including ours, requires you to have a valid contents insurance policy. While we have top-notch security like 24/7 CCTV and secure gate access, insurance is there to give you financial protection if something totally unexpected happens. You’ll need to show us proof that you’re covered before moving your things in.

Can I Just Use My Home Insurance?

Maybe, but you need to tread very carefully here. A lot of standard home insurance policies either don't cover items kept in a separate storage facility at all, or the cover they offer is so limited it won’t come close to the real value of your goods.

Before you assume you're covered, dig out your home policy documents and look for a specific clause mentioning 'goods in storage'. It must explicitly state that it protects your items for their full value for the entire time you’re renting the unit. Honestly, a dedicated self-storage policy is almost always the safer and more comprehensive bet.

How Do I Figure Out How Much My Stuff Is Worth?

The golden rule is to calculate the ‘new-for-old’ replacement cost. This isn't about what you'd get for your items on Gumtree; it’s about what it would cost you to walk into a shop and buy everything again, brand new, today.

The easiest way to do this is to jot down an inventory of your main items (like furniture, electronics, etc.) and then make a sensible estimate for the smaller bits, like boxes of books or clothes.

Getting this number right is important for two reasons:

- It guarantees you're fully covered and won’t be left out of pocket if you ever need to claim.

- It stops you from over-insuring and paying a higher premium than you need to.

What if I Add More Things to My Unit Later On?

No problem at all. If you bring more valuable items into your unit after you’ve already started renting, just get in touch with your insurance provider straight away to update your policy. It’s usually a very quick and simple process.

They’ll just adjust your total declared value and tweak your premium to match. Keeping your cover aligned with what’s actually in your unit is the best way to make sure you’re properly protected from start to finish.

Ready to secure your belongings with a trusted storage solution? At Orange Box Self Storage, we make it easy to find the perfect unit for your needs, with top-tier security and flexible terms. Get your instant online quote and reserve your unit in seconds at https://orangebox-selfstorage.co.uk.