Effective inventory management for small businesses is about so much more than just counting what’s on the shelves. It’s a core strategy that has a direct line to your cash flow and your customers' loyalty. Get it wrong, and it’s like trying to fill a leaking bucket—those small, unnoticed drips will slowly but surely drain your profits.

Why Poor Stock Control Is Costing Your Business Money

For a lot of small business owners, managing stock can feel like a constant juggling act. You're trying to avoid two equally damaging extremes: having way too much, or not nearly enough. Both scenarios put a real strain on your finances, turning what should be a valuable asset into a costly headache. Pinpointing these hidden costs is the first step toward plugging those leaks for good.

Think of it like this: every single item sitting on your shelf represents cash that isn’t doing anything for you. When products just sit there, your capital is tied up, stopping you from investing in growth, marketing, or other areas that could push your business forward. That's the quiet danger of overstocking.

The High Price of Too Much Stock

Excess inventory does more than just hog space; it actively eats into your resources. The costs of holding onto unsold goods can pile up faster than you’d think, often without business owners even realising the full scale of the problem.

These holding costs typically include:

- Storage Expenses: Whether you're paying for a warehouse, a third-party logistics provider, or even looking into secure self-storage options for home and business, every square metre your stock takes up comes with a price tag.

- Insurance and Security: More stuff means higher insurance premiums to cover you against theft, damage, or loss.

- Product Obsolescence: If you’re in a fast-moving industry like fashion or electronics, unsold items can quickly lose their value or become totally outdated.

- Spoilage: For businesses selling perishable goods, overstocking is a direct route to financial loss as products expire before you can sell them.

Inefficient inventory management doesn't just hurt your bottom line; it creates operational friction that slows down your entire business. Getting it right unlocks efficiency, improves cash flow, and builds a foundation for sustainable growth.

The Opposite Problem: Stockouts and Lost Trust

On the other end of the spectrum is the dreaded "out of stock" notification. While it might seem less serious than having too much inventory, running out of popular items can be just as damaging, if not more so. Every time a customer wants to buy something you don't have, you lose more than just that one sale.

You risk losing that customer for good and chipping away at your brand's reputation for being reliable. In an age where everyone wants everything yesterday, customers won't hesitate to go to a competitor who has what they need, right now. This erosion of trust is hard to put a number on, but it has a powerful long-term impact on your success, making robust inventory management for small businesses an absolute must.

Building Your Foundation with Inventory Fundamentals

Getting a grip on inventory management starts with understanding the basics, but without getting bogged down in confusing jargon. Think of it like learning the basic grammar of stock control—once you nail these core ideas, everything else just clicks into place. These concepts are the essential building blocks for a system that saves you money and keeps your customers coming back.

Let's kick things off with one of the most important terms you'll run into: the Stock Keeping Unit, or SKU. An SKU is a unique alphanumeric code you give to each specific product you sell. Imagine it as a unique fingerprint for every single item. If you sell a blue t-shirt in small, medium, and large, each size gets its own SKU.

This detail is absolutely crucial. It lets you track sales and stock levels for specific product variations, not just "blue t-shirts" in general. That precision helps you see which sizes are flying off the shelves and which are gathering dust, leading to much smarter buying decisions.

Understanding the Inventory Lifecycle

Every product you carry goes on a predictable journey, something we call the inventory lifecycle. If you can visualise this process, you can spot opportunities to improve at every stage, from the moment an item arrives to the moment it’s sold. Managing this cycle properly is the heart of good inventory control.

The typical lifecycle breaks down into five key stages:

- Purchasing: This is where it all starts. You order stock from your suppliers based on your sales forecasts and what you currently have on hand.

- Receiving: The goods arrive at your door. Your team checks them for accuracy and damage before officially adding them to your inventory records.

- Storing: Items are organised and stored in your stockroom, warehouse, or storage unit, ready and waiting for an order.

- Fulfilling: An order comes in! The item is then picked from the shelf, packed up, and shipped to the customer, officially leaving your inventory.

- Reordering: You look at your sales data and current stock levels to decide when it's time to repeat the cycle and purchase more.

The image below gives a great visual of how different cost components play into this whole framework.

As the diagram shows, there's a constant balancing act between ordering costs, holding costs, and the costs of running out of stock. The goal is to find that sweet spot to keep total expenses as low as possible.

Differentiating Your Types of Stock

Not all inventory is created equal, and knowing the difference is vital, especially if you make your own products. Your stock usually falls into one of three buckets, and each needs a slightly different management touch.

- Raw Materials: These are the basic ingredients or components you use to create your products. For a bakery, this is your flour, sugar, and eggs. For a furniture maker, it's the wood, screws, and varnish.

- Work-in-Progress (WIP): This category covers items that are partially assembled but not quite finished. Think of a half-built table or cakes that are still waiting to be iced. Tracking WIP is key to figuring out where your production process might be slowing down.

- Finished Goods: These are the final products, ready to be sold to customers. This is the only type of inventory most retailers deal with.

Grasping these fundamentals is the first step toward transforming your inventory from a passive cost centre into an active, profit-driving asset. It provides the clarity needed to make informed, strategic decisions.

Despite the obvious benefits, many UK businesses are still lagging. A recent study found that just 22% of small businesses use dedicated inventory management software. Even more surprising, 39% are still tracking stock manually or not at all. This reliance on outdated methods leaves businesses wide open to costly mistakes like overstocking and stockouts, which contribute to an estimated $1.6 trillion lost globally each year. You can find more insights on these small business inventory trends from this Statista research. Building a solid foundation on these core principles is your best defence against becoming another statistic.

Practical Inventory Techniques You Can Use Today

Now that we've covered the basics, let's get our hands dirty with some proven methods that successful small businesses use to keep their stock under control. Think of these techniques less as rigid rules and more as different tools in your toolkit. The real secret is finding the one that clicks with your specific business model and helps you truly master your inventory management for small businesses.

These methods give you a structured way to make smarter decisions about what to order, when to order it, and where to focus your energy. Honestly, putting even one of these into practice can lead to some pretty significant improvements in both your efficiency and your bottom line.

Embrace the First-In, First-Out (FIFO) Method

One of the most straightforward and widely used techniques is First-In, First-Out (FIFO). The idea behind it is beautifully simple: the first products you get into your inventory are the first ones you sell. It’s a completely logical approach that makes sure your older stock is cleared out before the newer stuff.

Imagine you run a small café. Every morning, you make a fresh batch of sandwiches. When a customer orders one, you naturally grab one from the morning's batch before you even think about touching any made that afternoon. It’s common sense, right? This stops the older sandwiches from going stale.

FIFO is absolutely vital for businesses dealing with:

- Perishable Goods: Think food, drinks, and cosmetics, where expiry dates are a constant worry.

- Products with a Short Shelf Life: This includes things like pharmaceuticals or certain supplements.

- Fast-Moving Electronics: In this world, newer models can make older versions obsolete almost overnight.

By sticking to FIFO, you dramatically cut down the risk of spoilage and obsolescence, shielding your business from losses you can easily prevent.

Focus Your Efforts with ABC Analysis

Let's be honest, not all of your stock is created equal. ABC analysis helps you accept this reality by applying the Pareto Principle—you've probably heard it called the 80/20 rule—to your storeroom. It's all about sorting your inventory into three groups based on its value and how often it sells.

- Category A: These are your superstars. They make up a small slice of your total inventory items (around 20%) but bring in the lion's share of your revenue (about 80%). These items need your full attention—close monitoring, regular stock counts, and meticulous demand forecasting.

- Category B: These are your steady, reliable performers. They're the middle ground, making up a moderate chunk of your stock and revenue (think 30% of items, 15% of revenue). They need consistent management, but not with the same intensity as your A-list items.

- Category C: These are the slow-movers. They account for the bulk of your inventory items (around 50%) but contribute very little to your overall revenue (maybe 5%). You can manage these with simpler controls and check on them less frequently.

This method is brilliant because it helps you point your limited time and resources exactly where they’ll make the biggest difference, ensuring your most profitable products are always in stock.

The Lean Approach of Just-In-Time (JIT) Inventory

Just-In-Time (JIT) is a more advanced technique where you order and receive inventory only when you need it for production or to fulfil customer orders. The whole point is to slash holding costs by keeping your stock levels as close to zero as possible. This approach can free up a huge amount of cash that would otherwise be tied up in unsold goods sitting on a shelf.

However, JIT is a bit of a high-wire act. It demands incredible precision and rock-solid, reliable suppliers. If a delivery is late or a supplier has a production hiccup, you could face immediate stockouts, bringing your operations to a grinding halt and leaving customers disappointed. For many small businesses, the risks that come with unpredictable supply chains make JIT a tricky strategy to pull off. A business needing a bit more of a safety net might find that flexible solutions, such as exploring shipping container storage for business inventory, offer a better balance between cost and security.

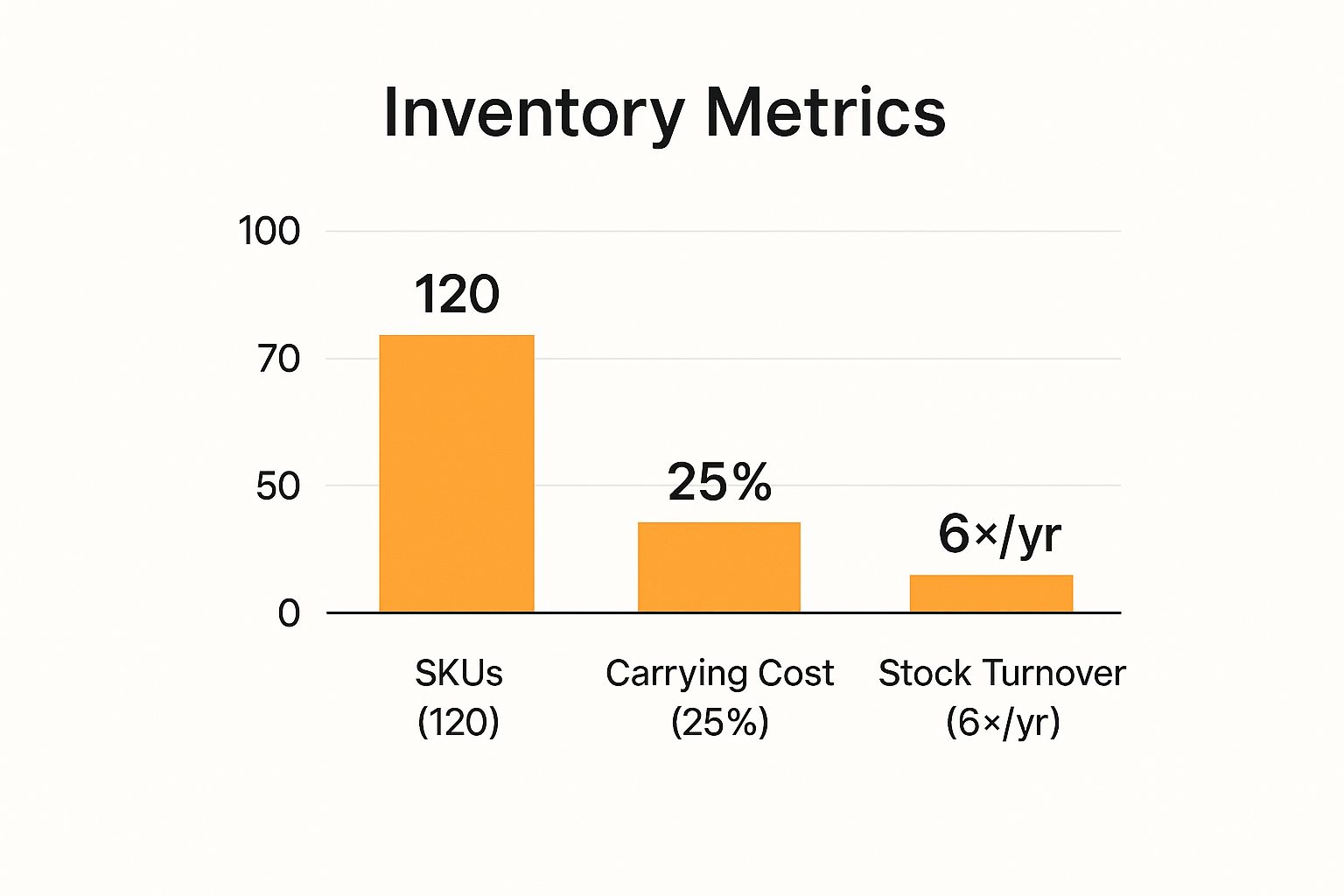

The infographic below gives you a snapshot of some of the typical inventory data points a small business might track.

This visual really brings home the connection between the number of products you handle, the cost of keeping them in stock, and how quickly they sell—all critical factors in picking the right technique for you.

Choosing the right inventory management technique is about balancing cost, risk, and customer satisfaction. The best method for your business will align with your product type, supplier reliability, and operational capacity.

For those who want to get hands-on without immediately investing in fancy software, spreadsheets can be a surprisingly powerful place to start. If you're looking to implement some of these methods yourself, check out this practical guide on essential inventory management formulas in Excel. It covers techniques like Economic Order Quantity and Reorder Point, helping you organise your data and make more informed decisions straight away.

Key Metrics for Smarter Inventory Decisions

You can't improve what you don't measure. While the techniques we’ve covered give you a framework, the real power in inventory management for small businesses comes from tracking the right numbers. Think of Key Performance Indicators (KPIs) as your business’s vital signs, turning pure guesswork into sharp, data-driven decisions.

These metrics are basically a dashboard for your stock. They give you a clear, unbiased look at how efficiently your inventory is working for you, highlighting where you’re strong and where you’re falling short. By keeping a close eye on these figures, you can spot slow-moving products, fine-tune your purchasing cycles, and ultimately give your bottom line a healthy boost.

Taking Your Business Pulse with Inventory Turnover Ratio

One of the most powerful metrics you can track is the inventory turnover ratio. This KPI reveals how many times your business has sold and replaced its entire stock over a specific period, usually a year. It's like a pulse check, showing you just how efficiently you're turning inventory into cold, hard cash.

A high turnover ratio generally means you're selling products quickly, which is fantastic for cash flow. A low ratio, on the other hand, suggests your stock is gathering dust, tying up capital and racking up holding costs.

To work it out, the formula is straightforward:

Inventory Turnover Ratio = Cost of Goods Sold (COGS) / Average Inventory Value

For instance, if your COGS for the year was £100,000 and your average inventory was valued at £20,000, your turnover ratio would be 5. This means you sold through your entire inventory five times that year—a single number that helps you benchmark your performance and spot opportunities for improvement.

Measuring Profitability with GMROI

While turnover tells you about speed, Gross Margin Return on Investment (GMROI) tells you about profitability. This metric answers a critical question: for every pound you sink into inventory, how much gross profit are you getting back? It draws a direct line between your stock and your profit margins.

A GMROI greater than 1 means you're making money on your inventory investment. The higher the number, the more profitable your stock is. But if it dips below 1, that’s a major red flag—you’re actually losing money on the products you’re holding.

Here’s how to calculate it:

- GMROI = Gross Margin / Average Inventory Cost

Let's say you had a gross margin of £60,000 and your average inventory cost was £20,000. Your GMROI would be 3, meaning you earned £3 in gross profit for every £1 invested in stock. This kind of insight is gold for making smart decisions about which product lines to expand and which to cut loose.

Pinpointing Sales Velocity with Sell-Through Rate

Finally, the sell-through rate gives you a much more granular view of performance. It compares the amount of stock you've sold against what you received from your supplier in a specific timeframe, making it perfect for gauging the success of a particular product or a seasonal promotion.

This metric is usually calculated monthly and expressed as a percentage:

- Sell-Through Rate = (Units Sold / Units Received) x 100

So, if you received 100 units of a new product and sold 75 in the first month, your sell-through rate is 75%. This is a powerful indicator of customer demand, helping you decide whether to reorder quickly or mark down a slow-seller before it becomes a problem.

Of course, using these metrics effectively depends on having accurate data. To get the most out of your inventory numbers and make truly data-driven decisions, it's worth exploring how tools like business intelligence (BI) can sharpen your operations. You can learn more about how hybrid BI improves inventory management and turns raw figures into game-changing insights.

Keep in mind that excess stock is a persistent challenge. For UK small businesses, inventory can represent 20–30% of total assets, and poor management can chew away 8–12% of annual revenue. Getting these metrics right isn't just about efficiency; it's about protecting your financial health.

Choosing the Right Inventory Management Software

Sooner or later, every growing business hits a wall with manual spreadsheets. Moving to dedicated software isn’t just an upgrade; it’s your ticket to better accuracy, efficiency, and insights that can genuinely shape your future. But let's be honest, the sheer number of options out there can be dizzying.

The trick is to find a tool that not only fixes your headaches today but can also keep up as you grow. Think of it like buying your first proper van after outgrowing the family car. You wouldn't get a two-seater sports car if you needed to haul stock. In the same way, the right inventory management for small businesses depends entirely on what you sell, how you sell it, and where you see yourself in a few years.

Core Features Every Small Business Needs

While every software platform has its bells and whistles, there are a few non-negotiable features that form the bedrock of a solid system. These are the tools that will make an immediate difference to your daily grind, saving you time and preventing those costly slip-ups right from the start.

Make sure any solution you look at has:

- Real-Time Tracking: The power to see accurate stock levels across all your sales channels, at any given moment. This is your best defence against overselling.

- Barcode Scanning: This dramatically speeds up everything from receiving goods to picking orders, and it pretty much wipes out human error.

- Automated Reordering: Lets you set minimum stock levels (or reorder points) that automatically flag when you’re running low, helping you dodge stockouts.

- Reporting and Analytics: Gives you clear data on sales trends, how fast your stock is moving, and profitability. This is what helps you make smarter buying decisions.

Standalone vs Integrated Systems

One of the first big forks in the road is choosing between a standalone inventory system or a fully integrated one. A standalone system does one thing: manage stock. It might seem simpler to get going, but it often works in a bubble, meaning you're stuck manually shifting data between your other business tools.

An integrated system, on the other hand, plugs directly into your other platforms—like your e-commerce site (Shopify or BigCommerce) and your accounting software (Xero or QuickBooks). This creates a single, reliable source of information. When a sale happens on your website, your inventory and accounts are updated instantly, with no extra work from you. For most businesses, an integrated solution is hands-down the better long-term bet.

For a small business, inventory management is the operational ‘command centre,’ directly influencing everything from cash flow and customer satisfaction to overall profitability. Choosing the right software is an investment in this command centre.

Good stock control, powered by the right tools, frees up cash for growth, prevents lost sales from empty shelves, and cuts down on waste from expired products. You can find more insights about how stock control is a core business function on mgselfstorageexeter.co.uk.

A Practical Checklist for Evaluating Software

To make sure you’re making a smart investment, go into conversations with vendors armed with a clear set of questions. This simple framework will help you compare your options fairly and find the one that truly fits your business.

Key Questions to Ask Potential Vendors:

- Scalability: Can your software handle a big jump in products (SKUs) and order numbers as my business grows?

- Integrations: Does it connect smoothly with my current e-commerce platform, accounting software, and shipping couriers?

- Ease of Use: Is the interface intuitive? How much training will my team need to get comfortable with it?

- Support: What kind of customer support do you offer? Is it available during my business hours, and is it included in the price?

- Pricing Structure: Is it a flat monthly fee, or does it change based on users, orders, or features? Are there any hidden setup costs I should know about?

By thinking through these points carefully, you can pick a software that doesn't just sort out your operations today but gives you a solid foundation to build on for years to come.

Your Step-by-Step Plan to Get Your Inventory in Order

Alright, turning theory into action is where the magic happens. We’ve covered the principles and the tools, so now it’s time to roll up our sleeves and build a proper inventory system. This isn't about some massive, intimidating overhaul; it's about following a clear roadmap, one manageable step at a time.

Yes, the initial setup will take some real focus and elbow grease. But the payoff is huge—more efficiency, better profits, and a whole lot less stress. Think of it this way: a well-organised system is the engine that powers your growth, freeing you up to think about the bigger picture instead of constantly putting out fires in the stockroom.

Step 1: Do a Full Physical Stock Count

Before you can fix anything, you need to know exactly what you’re working with. The first, non-negotiable step is to count every single item you have in stock. This gives you a true baseline and often uncovers some surprising gaps between what you thought you had and what’s actually sitting on the shelves.

To make this as painless as possible:

- Schedule It Right: Pick a time when the business is quiet or closed. The last thing you need is interruptions.

- Use a Team: Get your team involved. Working in pairs—one counting, one recording—is a great way to speed things up and slash the error rate.

- Be Methodical: Work through your stockroom section by section. The goal is to make sure nothing gets missed or double-counted.

Step 2: Organise Your Physical Space

An organised stockroom is a fast stockroom. Simple as that. Once you have an accurate count, the next job is to arrange everything for maximum clarity and efficiency. A logical layout makes finding items a breeze, cuts down on picking errors, and makes future stock counts far less of a chore.

Take a good look at your current setup. Can it be improved? Label your shelves and bins clearly with product names and SKUs. Put your best-sellers (your ‘A’ products from the ABC analysis) in the most accessible spots to shave valuable seconds off every order.

If you’re tight on space, don't let clutter compromise your system. Exploring options for off-site business storage can be a real game-changer, giving you the breathing room to organise your main workspace properly.

Step 3: Train Your Team and Lock in Your Procedures

Your inventory system is only as strong as the people using it. Whether you’re bringing in new software or just formalising what you already do, proper training is absolutely vital for consistency. Every single person who handles stock needs to understand the new procedures and why they matter.

Document simple, clear guidelines for the most important tasks:

- Receiving Stock: How to check deliveries against purchase orders and log them in the system.

- Fulfilling Orders: The exact process for picking, packing, and updating stock levels as items go out the door.

- Handling Returns: How to inspect returned goods and correctly add them back into your inventory.

A successful inventory system is built on two pillars: the right tools and consistent human processes. Empowering your team with clear procedures ensures the system works as intended day in and day out.

Finally, get a regular audit schedule in the diary. That initial full count is crucial, but it’s the ongoing checks—like weekly cycle counts or quarterly full audits—that will keep your data accurate in the long run. This proactive approach turns inventory management for small businesses from a reactive headache into a powerful strategic advantage.

Still Have Questions About Inventory Management?

Even with a solid plan, questions about the day-to-day realities of stock control are bound to pop up. Let's tackle some of the most common queries we hear from small business owners, with clear and direct answers to help you navigate the practical hurdles.

What Is the First Step to Improve My Inventory Management?

The very first step is a complete physical stock count. Before you even think about new software or systems, you need an accurate, real-world baseline of every single item you have.

This process almost always uncovers discrepancies between your records and reality, highlighting problem areas right from the start. Think of it as creating a clean slate—without this foundational data, any new system will be built on flawed information, and your decisions will be just as shaky.

How Often Should My Business Do a Full Stock Count?

The ideal frequency really depends on your business, but a common approach is to perform a full, wall-to-wall stock count once per year. This comprehensive audit is essential for financial reporting and gives you a definitive snapshot of your inventory's health.

But relying solely on an annual count isn't enough. Many businesses supplement this with cycle counting—a method where you count small, specific portions of your inventory on a rotating schedule, maybe daily or weekly. This continuous process helps maintain accuracy all year, catch errors early, and avoid the massive disruption of a full shutdown.

For many small businesses, a hybrid approach works best. Use an annual count for year-end financials and regular cycle counts to keep your data clean and your operations running smoothly.

Can I Manage Inventory with a Spreadsheet Instead of Software?

Yes, you absolutely can start with a spreadsheet. For a very small business with a handful of products, it can be a perfectly workable solution. Spreadsheets are free and familiar, which is a huge plus when you're just starting out.

The problem is, they have some serious drawbacks. They're prone to human error, offer no real-time updates, and don't scale well as your business grows. As soon as you start selling on multiple channels or your product list expands, spreadsheets quickly become clunky and a genuine liability for effective inventory management for small businesses.

How Do I Deal with Dead Stock That Isn't Selling?

Dead stock—inventory that hasn't sold for a long time—is a silent business killer. It ties up your capital and hogs valuable shelf space. The best way to handle it is to act decisively to shift it and recover at least some of your investment.

Here are a few strategies to try:

- Bundle It: Pair a slow-moving item with one of your bestsellers as a package deal.

- Offer a Deep Discount: A flash sale or a clearance event can move old stock surprisingly quickly.

- Donate It: Donating the items to a registered charity can provide a tax write-off and generate some goodwill for your brand.

The main thing is to cut your losses. Free up that cash and space for products that people actually want to buy.

Struggling with space as you get your inventory organised? Orange Box Self Storage offers secure, flexible, and affordable business storage solutions to help you manage your stock without cluttering your workspace. Find the perfect unit for your needs at https://orangebox-selfstorage.co.uk.