Buying your first home is one of life's most exciting milestones, but it can also feel like navigating a complex maze of paperwork, inspections, and financial hurdles. The journey from eager house-hunter to proud homeowner is filled with critical steps that, if overlooked, can lead to costly delays and unexpected stress. This comprehensive first house checklist is designed to be your compass, guiding you through each stage of the process with clarity and confidence.

We'll break down the essential tasks, from securing your finances to the final moments before you get the keys, ensuring you're fully prepared for a smooth and successful purchase. This isn't just a list; it's an actionable blueprint meticulously organised to help you manage the complexities of the property market. By following these steps, you can avoid common pitfalls and make informed decisions at every turn. Forget the generic advice and overwhelming jargon; this guide will turn the dream of homeownership into a well-planned reality. For a more in-depth look at the entire timeline from start to finish, you can explore a detailed UK house buying process to understand each stage comprehensively. Now, let’s get started.

1. Securing Your Pre-Approval Letter: The Golden Ticket

Before you even dream of colour swatches or new furniture, the very first item on your first house checklist should be securing a mortgage pre-approval. This isn't just a casual estimate; it's a formal declaration from a lender confirming the amount they are provisionally willing to lend you. Think of it as the ultimate pass that turns you from a window shopper into a serious contender.

Why It's Non-Negotiable

A pre-approval letter provides two critical advantages. Firstly, it gives you a concrete budget, preventing the disappointment of falling for a property that is financially out of reach. Secondly, it signals to estate agents and sellers that you are a credible and prepared buyer, giving you a significant edge in a competitive housing market. Many agents won't even schedule a viewing without one.

The Pre-Approval Process

To get pre-approved, you'll need to provide a lender with detailed financial documentation. This typically includes:

- Proof of Income: Recent payslips, P60s, or tax returns if you're self-employed.

- Proof of Identity and Address: Your passport or driving licence and recent utility bills.

- Bank Statements: Usually the last three to six months to show your spending habits and deposit savings.

- Credit History: The lender will perform a hard credit check.

It's vital your credit file is in good order before you apply. If you’ve noticed fluctuations, it’s worth taking the time to understand why your credit score might be dropping and address any issues first. A strong credit history can directly influence the interest rates you're offered.

Key Insight: A pre-approval is different from a pre-qualification or an agreement in principle. A pre-approval involves a thorough financial verification and a hard credit check, making it a much stronger and more reliable document to have when making an offer.

2. Booking a Professional Home Inspection: Your Safety Net

Once your offer on a property has been accepted, the next critical step on your first house checklist is to arrange for a professional home inspection. This is not a mere formality; it is a comprehensive evaluation of the property's condition, from the roof to the foundations, carried out by a qualified surveyor or inspector. This report is your best defence against unforeseen and potentially expensive problems.

Why It's Non-Negotiable

A professional inspection provides an unbiased assessment of the property's structural integrity and major systems, including plumbing, electrical, and heating. It can uncover hidden issues that aren't visible during a viewing, such as damp, subsidence, or an ageing boiler. For example, an inspector might discover a foundation issue that costs £15,000 to fix, giving you the leverage to negotiate a price reduction or request the seller rectifies it before completion. This report empowers you to make an informed decision, proceed with confidence, or walk away from a potential money pit.

The Home Inspection Process

Choosing the right inspector is crucial. Look for accredited professionals with solid reviews and experience with properties similar to the one you are buying. The inspection itself will take a few hours, and you should make every effort to attend. This allows you to ask questions directly and see any issues firsthand. A comprehensive report will typically include:

- A detailed property survey: An overview of the building's condition, highlighting any major defects.

- System analysis: An evaluation of the electrical, plumbing, heating, ventilation, and air conditioning (HVAC) systems.

- Structural assessment: An inspection of the roof, foundations, walls, floors, and windows.

- Safety checks: Identification of potential hazards like faulty wiring, asbestos, or lead paint, which may require a specialist survey.

Always focus on the major structural and mechanical findings rather than minor cosmetic flaws. Organisations like the Royal Institution of Chartered Surveyors (RICS) in the UK provide standards and directories for qualified professionals.

Key Insight: A home inspection is not a pass-or-fail test. It is an objective report on the property's current state. Use the findings not just to identify deal-breakers but also to budget for future maintenance, such as knowing the HVAC system has only a few years of life left.

3. Conducting a Thorough Neighbourhood and Location Analysis

While the house itself is the star of the show, its setting plays a crucial supporting role that can make or break your long-term happiness. A thorough neighbourhood and location analysis is an indispensable part of your first house checklist. It involves looking beyond the property line to evaluate the area's character, amenities, and future prospects, ensuring the location aligns with your lifestyle and financial goals.

Why It's Non-Negotiable

You can change almost anything about a house, but you can never change its location. This decision impacts everything from your daily commute and weekend activities to your property's future resale value. A family might accept a longer commute to secure a place in a top-rated school district, while a savvy buyer might research a planned transport expansion and purchase a home that appreciates by 40% in five years.

The Location Analysis Process

Digging deep into a potential neighbourhood requires more than just a quick drive-through. A comprehensive evaluation involves both on-the-ground research and digital sleuthing.

- Visit at Different Times: Experience the area on a weekday morning, a weeknight, and over the weekend. Note the traffic, noise levels, and general atmosphere.

- Talk to the Locals: Chat with potential neighbours you see out and about. Ask them what they love about the area and what they wish they could change.

- Research Development Plans: Check the local council’s website for planning applications and meeting minutes. Are there major infrastructure projects or new housing developments on the horizon?

- Assess Amenities and Commutes: Use online tools like Walk Score to check proximity to shops, parks, and restaurants. Map out your commute during peak hours to get a realistic travel time.

Key Insight: Your analysis should be forward-looking. Consider not just your current needs but also your future life plans. If you're thinking of starting a family, school catchment areas become critical. If you're nearing retirement, proximity to healthcare and community centres might be more important.

4. Down Payment and Closing Cost Preparation

With your pre-approval in hand, the next critical financial milestone is preparing for the substantial upfront costs of buying a home. This isn't just about the deposit; it involves a significant amount of cash for both the down payment and various closing costs. Properly budgeting for these figures is a non-negotiable step in your first house checklist and is essential for a smooth and successful transaction.

Why It's Non-Negotiable

Failing to account for both the down payment and closing costs can derail your purchase at the final hurdle. The down payment directly impacts your mortgage terms, monthly payments, and whether you'll need to pay Private Mortgage Insurance (PMI). Closing costs, which cover legal fees, surveys, and lender charges, are mandatory expenses required to finalise the sale. Being financially prepared demonstrates to your lender and solicitor that you are ready to proceed without delays.

Breaking Down the Costs

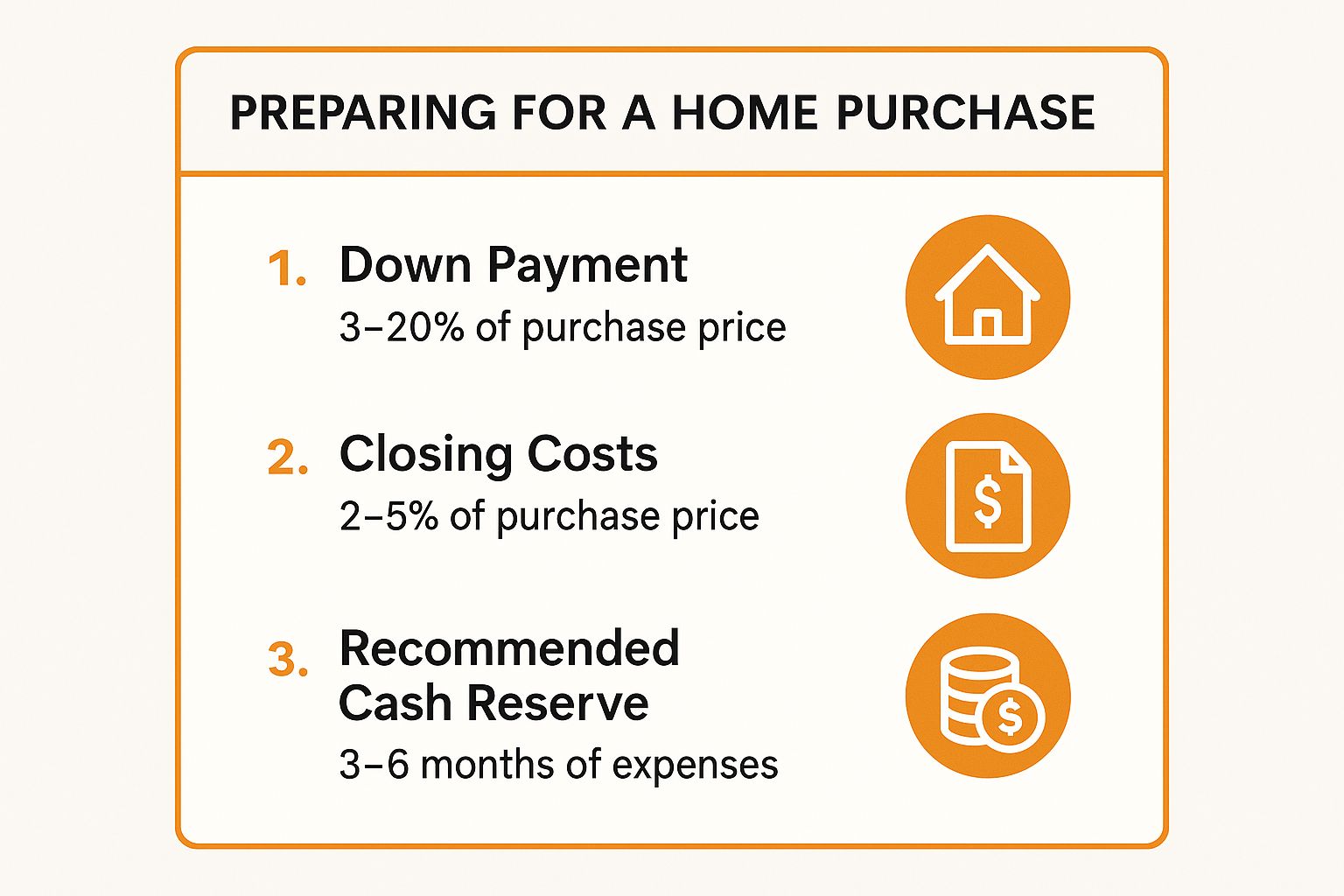

Understanding these two distinct costs is key to effective financial planning. Here's what you need to prepare for:

- Down Payment: This is the portion of the property's purchase price you pay upfront. While traditionally 20% is the goal to avoid PMI, many loan programmes for first-time buyers allow for as little as 3-5%.

- Closing Costs: These are the fees associated with completing the property transaction, typically amounting to 2-5% of the home's purchase price. This includes everything from solicitor fees and land registry fees to mortgage arrangement fees.

- Cash Reserves: Lenders often want to see that you have a financial cushion left over after the purchase. Aim to have three to six months' worth of essential living expenses saved in an emergency fund.

To help you visualise these key financial targets, the summary box below provides a quick reference for your savings goals.

As the infographic illustrates, planning for these three distinct funds is crucial for a financially sound home purchase.

Key Insight: Don’t drain your savings entirely on the down payment and closing costs. Lenders look favourably on buyers who retain a healthy cash reserve, as it shows you can handle unexpected repairs or financial emergencies without risking mortgage default.

5. Conducting a Title Search and Securing Insurance: Your Ownership Shield

After your offer is accepted, one of the most crucial background checks begins: the title search. This is a meticulous legal examination of public records to confirm the seller's right to transfer ownership and to uncover any hidden claims, liens, or legal issues attached to the property. It’s an indispensable step on your first house checklist that protects you from inheriting someone else's problems.

Why It's Non-Negotiable

A clean title is the foundation of secure homeownership. A title search can reveal issues like an unpaid contractor's lien, unresolved boundary disputes, or even legal claims from a previous owner's heir. Without this check, you could be liable for these debts or face complex legal battles over your right to the property. Title insurance then provides a financial safety net, protecting you against losses from title defects that are discovered after you've completed the purchase.

The Title Process

Your solicitor or conveyancer will typically arrange for a title search company to perform this investigation. The process involves examining historical records, deeds, and legal filings related to the property. Key steps and outcomes include:

- Initial Search: The company scours public records for any issues like liens, easements (rights for others to use your land), or covenants that restrict property use.

- Title Commitment: You'll receive a report detailing the findings. For example, it might reveal an outstanding mortgage from a previous owner that must be settled before the sale can proceed.

- Resolving Issues: If problems are found, such as a legal claim arising from a past owner's divorce decree, they must be legally clarified and resolved before closing.

- Securing Insurance: Once the title is deemed clear, you will obtain title insurance. The lender will require a policy to protect their investment, but it's highly advisable to purchase an owner's policy for your own protection as well.

Key Insight: Don't confuse the lender's title insurance policy with an owner's policy. The lender's policy only protects their financial interest in the property. An owner's policy is a one-off payment that protects your equity and legal rights to the home for as long as you or your heirs own it.

6. Arranging Homeowners Insurance: Your Financial Safety Net

As you approach the final stages of your purchase, arranging homeowners insurance becomes a crucial step on your first house checklist. This isn't an optional extra; it's a fundamental layer of protection for what is likely your largest asset. Lenders will almost always require proof of an active policy before they release mortgage funds, making it an essential task to complete before your closing date.

Why It's Non-Negotiable

Homeowners insurance safeguards your property and possessions against unforeseen events like fire, theft, or flood damage. More than just protecting the building itself, it provides liability coverage, which is vital if someone is injured on your property. Without it, you would be personally responsible for covering potentially astronomical costs for repairs, replacements, and legal fees, putting your financial future at significant risk.

The Insurance Arrangement Process

Start shopping for quotes as soon as your offer is accepted. The process involves providing an insurer with details about the property to assess risk and determine your premium. This typically includes:

- Property Details: The home’s age, construction materials, square footage, and any security features.

- Coverage Levels: Decide between replacement cost (pays to rebuild your home to its original standard) and actual cash value (pays the current market value, which is less due to depreciation).

- Personal Information: Your claims history and credit information can influence the premium you are offered.

- Proof of Policy: You will receive a policy binder or declaration page to provide to your mortgage lender.

It is wise to compare offers from various providers like State Farm or Allstate to find the best balance of coverage and cost. Bundling your home insurance with your car insurance often unlocks significant discounts, so be sure to ask about multi-policy savings.

Key Insight: Ensure your policy starts on your official closing date, not the day you move in. You are legally responsible for the property from the moment the sale is finalised, so having immediate coverage is essential to protect your investment from day one.

7. Conducting the Final Walk-Through: Your Last Line of Defence

Just before you collect the keys, the final walk-through is your last opportunity to ensure the property is in the condition you agreed upon. This critical inspection, typically conducted 24 to 48 hours before completion, is not another home survey but a verification exercise. It’s your chance to confirm that the property is as you remember it, all agreed-upon repairs have been made, and no new issues have cropped up since your last visit.

Why It's Non-Negotiable

Skipping this step on your first house checklist can lead to costly and frustrating surprises after you've moved in. Imagine discovering the seller has removed the custom-fitted blinds or that the boiler repair you negotiated was never actually completed. The walk-through protects your investment by giving you leverage to address these problems before the final funds are transferred, when the seller is still motivated to resolve them.

The Walk-Through Process

This is a hands-on task. Arm yourself with your original inspection report and the purchase agreement to ensure everything lines up. A systematic approach is best:

- Bring Your Checklist: Use your home survey report as a guide to double-check that negotiated repairs have been completed to a satisfactory standard.

- Test Everything: Methodically switch on every light, run all taps (checking for hot water), flush every toilet, and test all included appliances. Check that garage door openers and any remotes are present and working.

- Verify Fixtures and Fittings: Ensure items that were meant to be included in the sale, like curtains, appliances, or light fittings, are still in place.

- Document Immediately: If you spot a problem, take clear photos and videos. For example, if a promised repair to a leaky tap hasn't been done, a quick video is undeniable proof. Contact your solicitor immediately to report the discrepancy.

Key Insight: The final walk-through is not the time to be shy or rushed. This isn't just a casual look-around; it's a crucial contractual checkpoint. A major issue found now, such as a seller taking an integrated dishwasher, could result in a credit at closing or a delay until the matter is rectified.

First House Checklist Comparison

| Item | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Pre-Approval Letter from Lender | Moderate (financial documentation and credit check) | Requires credit, income docs, lender time | Verified loan amount, strengthens buyer offers | Early stage of home buying, budgeting | Speeds closing, sets clear budget, reveals credit issues |

| Professional Home Inspection | Moderate (scheduling, onsite inspection) | Inspection fee ($300-600), licensed inspector | Identifies hidden defects, negotiation leverage | Before finalizing purchase | Detects costly issues, estimates maintenance needs |

| Neighborhood and Location Analysis | High (research and visits) | Time-intensive research, access to data sources | Insight into quality of life, resale potential | Choosing where to buy | Protects investment, ensures long-term satisfaction |

| Down Payment and Closing Cost Preparation | Low to Moderate (financial planning) | Significant savings required, financial documents | Smooth transaction, affects loan terms and payments | Pre-purchase financial readiness | Reduces loan costs, shows financial stability |

| Title Search and Insurance | Moderate (legal and document review) | Title search fees ($500-2000), insurance premium | Confirms ownership, protects against legal claims | Prior to closing | Prevents ownership disputes, legally required by lenders |

| Homeowners Insurance Arrangement | Low to Moderate (policy shopping and setup) | Annual premiums ($1000-3000), documentation | Property and liability protection | Mandatory before closing, risk management | Protects investment, liability coverage |

| Final Walk-Through Inspection | Low (brief final check) | Time for walk-through, checklist | Confirms property condition, verifies repairs | 24-48 hours before closing | Prevents last-minute issues, verifies contract compliance |

From Checklist to Keys in Hand: Your Next Chapter

Embarking on the journey to homeownership is one of life's most significant milestones. The path from dreaming about your first property to finally holding the keys is paved with critical details, deadlines, and decisions. This comprehensive first house checklist was designed not just as a list to tick off, but as a strategic roadmap to navigate the complexities of the property-buying process with confidence and clarity. By methodically working through each stage, you have transformed an overwhelming prospect into a series of manageable, actionable steps.

From securing your mortgage pre-approval to meticulously preparing for the down payment and closing costs, you’ve established a robust financial foundation. This crucial groundwork ensures that your investment is both sound and sustainable, protecting you from future financial strain. Similarly, your due diligence in conducting a professional home inspection and a thorough neighbourhood analysis moves beyond the surface level, empowering you to understand the true condition and long-term viability of your chosen home. These are not mere formalities; they are the cornerstones of a wise property investment.

The True Value of Diligent Preparation

Mastering this checklist provides more than just peace of mind; it equips you with the knowledge to make informed decisions at every turn. Understanding the importance of a clear title search, arranging comprehensive homeowners insurance, and performing a detailed final walk-through are the final safeguards that protect your significant financial and emotional investment. Each item on the list serves a distinct purpose:

- Financial Security: Preventing unexpected costs and ensuring your mortgage is manageable.

- Physical Integrity: Uncovering potential issues with the property before they become your responsibility.

- Legal Protection: Ensuring your ownership is legitimate and undisputed.

- Future Livability: Confirming that the home and its surroundings meet your lifestyle needs for years to come.

You have now built a framework for success, turning potential anxieties into a structured, proactive plan. The reward is not just a set of keys but the profound sense of security and accomplishment that comes with owning a place that is truly yours. This diligence is the first, and most important, step in creating a home where you can build memories, grow, and thrive. As you transition from buyer to homeowner, remember that this same thoughtful planning will serve you well in the exciting chapters to come. Welcome home.

Making your new house a home often involves renovations, decorating, or simply a gradual move-in process. If you need a secure, flexible space to store belongings while you settle in or declutter, Orange Box Self Storage offers a range of personal storage solutions perfect for new homeowners. Find your ideal storage unit and simplify your move at Orange Box Self Storage.